Urban Tech Index I Q4-25

Urbantech Index Q4 2025 – Key Insights

Axeleo Capital (AXC) publishes the latest edition of its “Urbantech Index”, a quarterly review of the European Urbantech ecosystem that monitors the pace of investments and innovation in Urbantech SaaS in Europe. This analysis focuses on B2B SaaS startups across the Energy, Construction (Contech), and Real Estate (Proptech) verticals.

Quantitative Insights

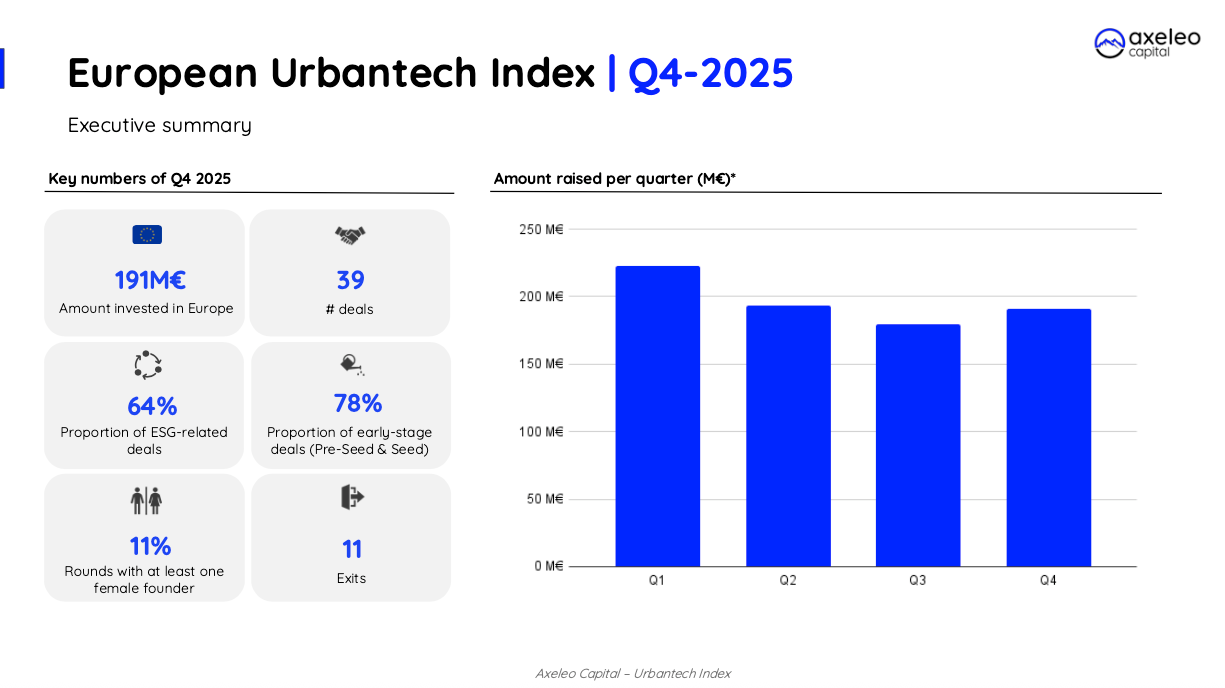

European Urbantech SaaS secured €191 million across 39 deals in Q3 2025. While the total amount invested is higher than Q3 (€191M vs. €179M), the number of transactions slightly decreased (39 vs. 42), signaling a larger average ticket size. Early-stage activity continued to dominate, with 78% of deals at Pre-seed and Seed, underlining the sector’s strong innovation potential despite a more selective investment climate.

Zooming out, Q4 2025 confirms the resilience of the European Urbantech ecosystem, with steady deal activity compared to the previous quarter and clear progress versus earlier periods of weaker fundraising.

Geographical breakdown: UK leading, the Germany and Italy following

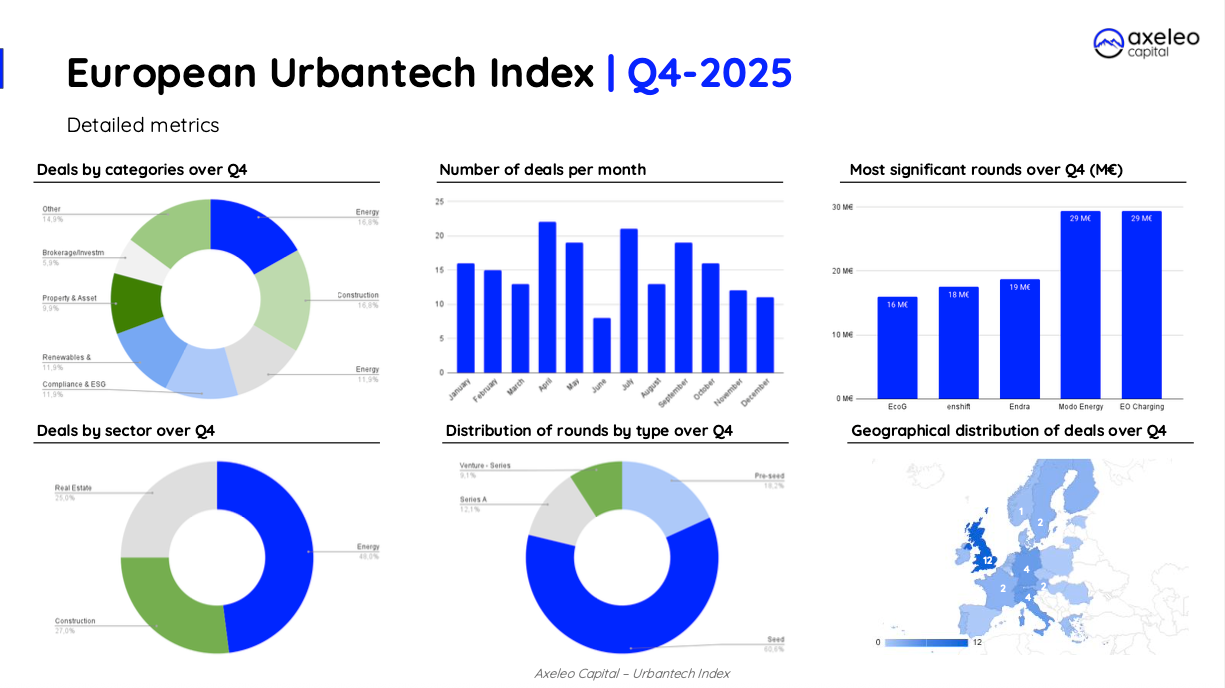

UK was by far the most active market this quarter with 12 deals, ahead of the UK (4 deals) and Italy (4 deals). Sweden, France and Austria recorded 2 transactions.

France experienced a significantly quieter quarter, with just two disclosed deals, including Revolt.eco (€2.2M Seed).

Energy and Construction Lead Sector Activity

Top funded Urbantech categories in Q4 2025 were:

- Energy management (25%)

- Construction operations (17%)

- Energy optimization & grid (10%)

- Compliance & ESG (10%)

- Renewables & Greentech (7%)

- Property & Asset management (5%)

Together, Energy-related solutions captured nearly half of total funding (48%), confirming investor appetite for efficiency, resilience, and infrastructure digitization.

Early-Stage Momentum Continues

Early-stage rounds (Pre-seed and Seed) made up 78% of total deals, with 20 Seed and 6 Pre-seed rounds completed this quarter.

Top Deals of the Quarter

- EO Charging (UK) – €29.4M

EV charging infrastructure software and services for commercial fleets and large-scale deployments.

- Modo Energy (UK) – €29.4M

Data and analytics platform for battery storage, energy assets, and flexibility markets.

- Endra (SW) – €18.7M

AI-powered platform automating the design of MEP (mechanical, electrical, plumbing) systems in construction projects.

- enshift (DE) – €17.5M

Software enabling energy flexibility and demand response for industrial and commercial buildings.

- EcoG (DE) – €16.0M

Operating system for EV charging infrastructure, enabling hardware-agnostic and scalable deployments.

- nPlan (UK) – €15.0M

AI-based predictive analytics for large-scale construction projects, improving risk management and delivery timelines.

Diversity Remains a Challenge

Only 4 deals this quarter involved at least one female founder, a modest step forward but still reflecting the structural lack of diversity in founding teams across Urbantech, especially at later stages

Exit Activity

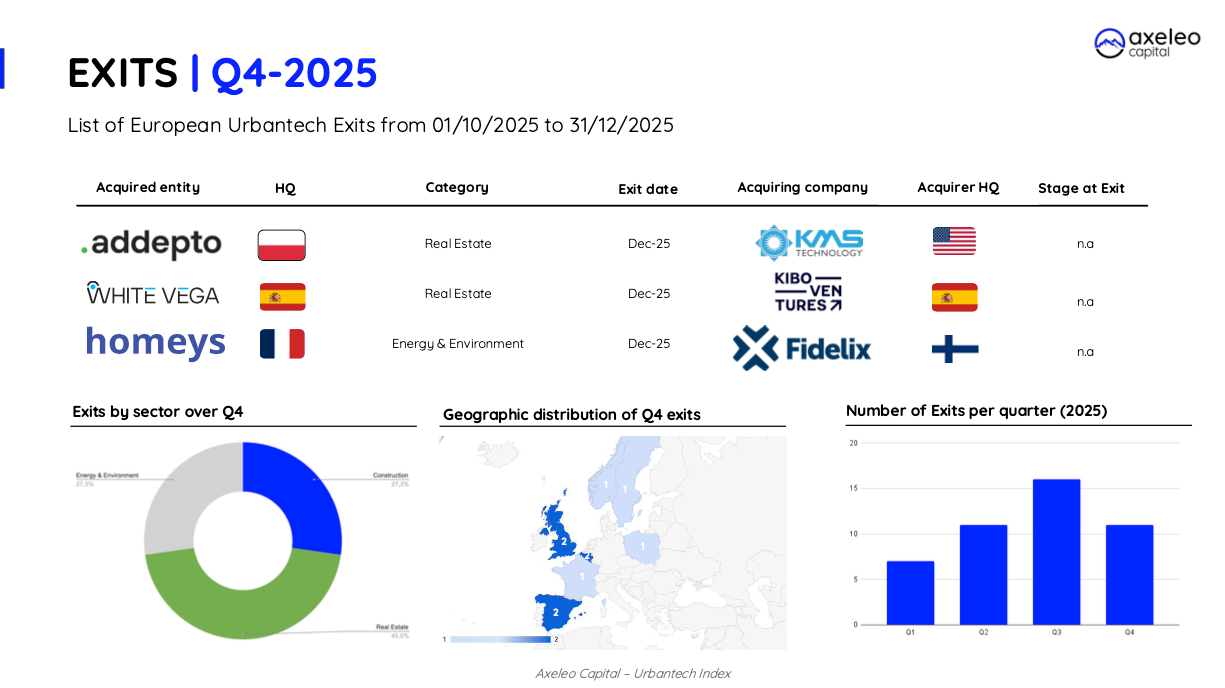

Q4 recorded 11 exits, confirming the M&A momentum observed in Q3 and underlining the European ecosystem’s growing maturity.

Notable transactions included:

- Addepto (PL) acquired by KMS Technology (US) – Real Estate analytics

- White Vega (ES) acquired by Kibo Ventures (ES) – Real Estate

- Homeys (FR) acquired by Fidelix (FI) – Energy & Environment

- Gurkfast i Sverige (SE) acquired by Aqtira (SE) – Construction

- Lexeri (ES) acquired by Cleon Capital (ES) – Real Estate

- Apsiyon (TR) acquired by Aareon (DE) – Real Estate (Series A exit)

Methodology:

The Urbantech Index is based on data from Axeleo Capital analysis as well as databases, such as Crunchbase. These data sources mainly gather information on deals and rounds that have been publicly disclosed - many other raises are taking place, but without announcements or communications on amounts (thus difficult to track). The analysis is limited to SaaS companies headquartered in Europe, and with a value proposition focused on Construction, Real Estate and Energy. As far as recorded fundraising is concerned, this refers to equity venture capital fundraising only (i.e. excluding debt fundraising, subsidies and aid other than equity).

About Axeleo Capital:

Axeleo Capital is a venture capital firm active on the European technology scene and backed by a large pool of entrepreneur-investors. The fund offers founders a unique support framework that combines equity investment, operational and strategic coaching and an active ecosystem of over 100 high-level partners and mentors. Its Urbantech investments include Garantme, Check&Visit, Beanstock, Mob Energy, Pionix or Offroad.