Geothermal in Europe: Reality-check

Climate Tech is having a geothermal moment right now, driven by the surging energy demands of data centers, significant financing and a new political agenda in the US, the sector is experiencing a renaissance.

Looking at it from our European Investor perspective: Is there a path for broader geothermal deployment in Europe that doesn't rely on massive CAPEX or long time to market drilling tech?

Let’s be clear: we are not dismissing breakthroughs. We want to explore a pragmatic approach. Focusing on short-to-mid-term horizons, assessing what is realistically financeable in Europe today and the role geothermal can play in the energy mix.

Given our fund’s thesis on hardware technologies, this article focuses on technologies ranging from drilling to surface development. A good addition to our perspective would be the recent EDF Pulse Ventures mapping, also covering exploration technology deemed crucial to bring less uncertainty in project development.

Heat & Electrons today in Europe: a tale of two markets

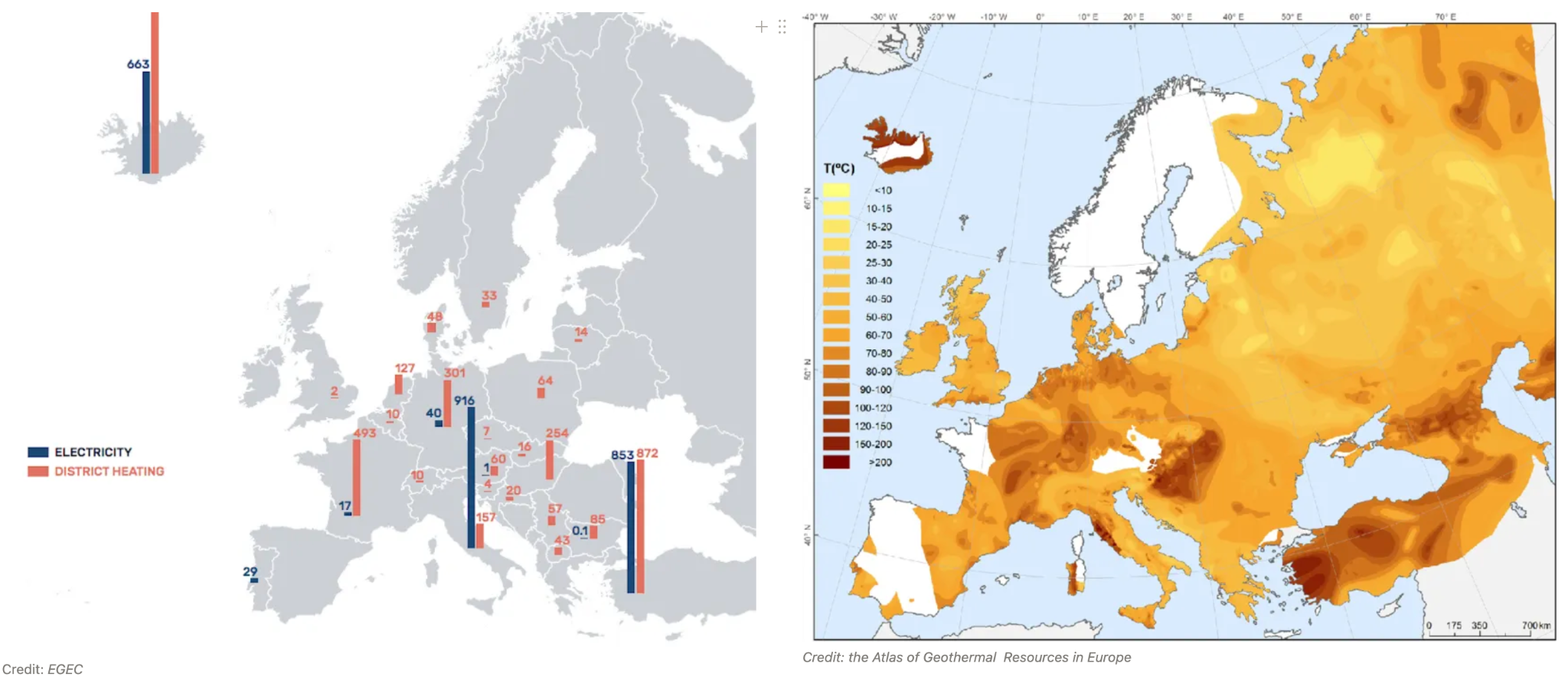

The EGEC (European Geothermal Energy Council [1]) publishes excellent figures annually about the state of the European market:

- Electricity: Europe (including Turkey) currently holds 3.5 GW of geothermal electricity capacity (1 GW within the EU), generating roughly 20 TWh across 147 plants. This year, we saw 3 new plants add just 40 MW to the mix (+1.2%). It’s 80x less than wind capacity.

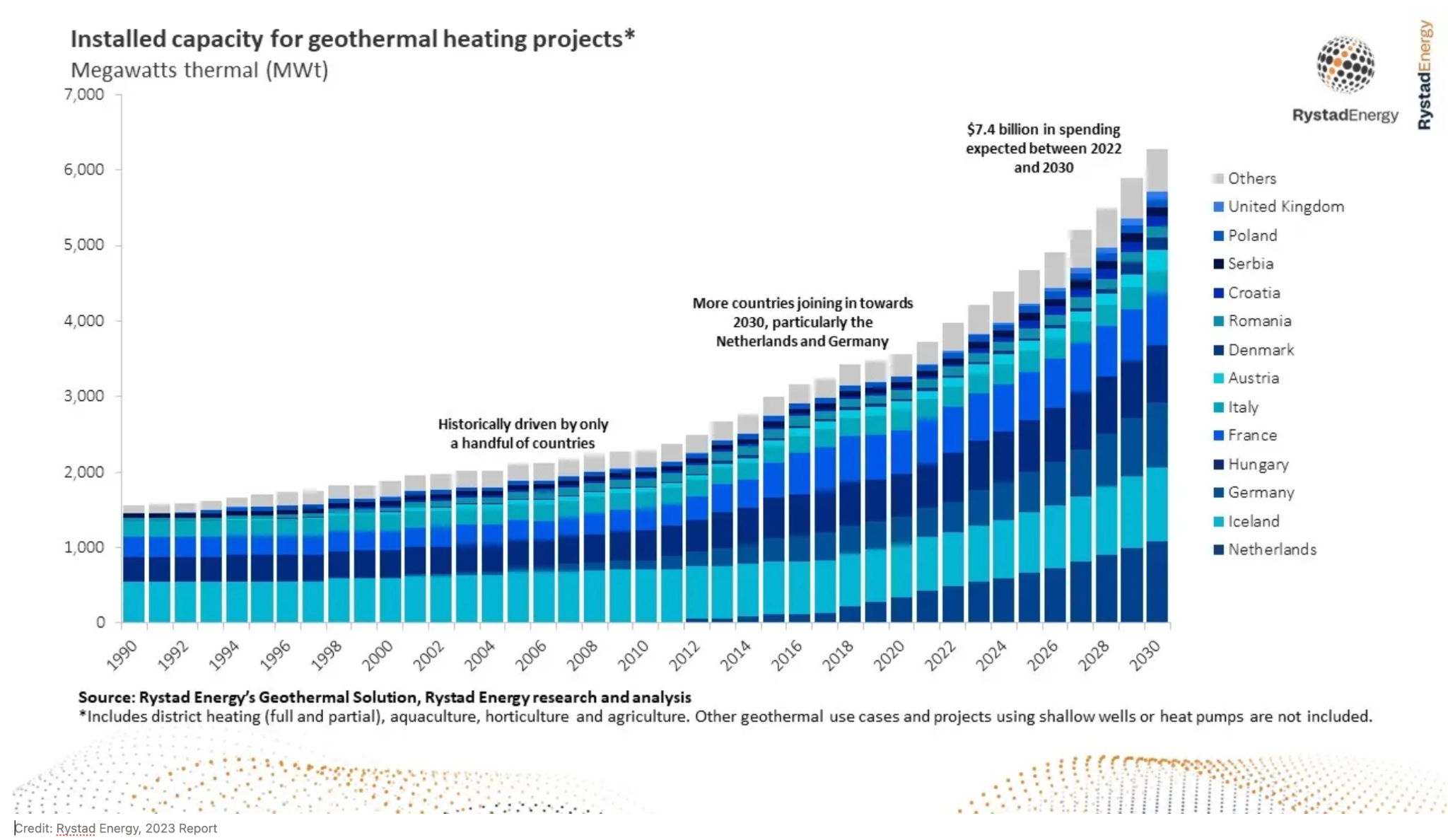

- Heating: The brighter spot. Europe has reached 6 GW of thermal capacity, with 10 new systems adding around 110 MW this last year (+2%).

Contrasting with the US geothermal electricity growth (+11%)[2] Europe statistics seem underwhelming.

One of the reason is geological: the Western US benefits from superior resources compared to Continental Europe. For instance, if we look at the maps and atlases, in the US, the electrical temperature (150°C) is often half as deep as the average in Europe (3-4km vs. 5-6km).

Yet this geological advantage tells only one part of the story: when the ressource is available and therefore economically viable (high temperature at low depth), geothermal energy is already deployed at scale.

- Placing the two maps on top of each other, the dominance of electricity projects in Italy and Turkey is correlated with significant heat resources available at manageable depths of 2,000 meters

- Also, heating projects are more distributed across Europe displaying an interesting dynamic, with significant policy push: 400 projects are currently being studied. Germany alone is expected to quadruple its District Heating and Cooling (DHC) capacity, with 170 systems already in development and a target of a 100 by 2030 [3]. These pledges are backed by significant subsidies program to prepare the infrastructure and de-risk investment. For instance, the German €3bn BEW program (Federal Funding for Efficient Heating Networks) finance up to 40% of heating networks. To facilitate private financing, the Netherlands have introduced the RNES, a state-backed guarantee scheme that insures projects against unproductive wells and drilling failures.

Geology is one reason for Europe's slower adoption of geothermal power. On the other hand, a favorable subsidy scheme across France, Germany, the Netherlands, Denmark has certainly prioritized heat projects over electricity.

Ultimately, though, the decisive factor is cost: the substantial upfront investment required poses a major hurdle for geothermal projects development.

Increasing geothermal costs

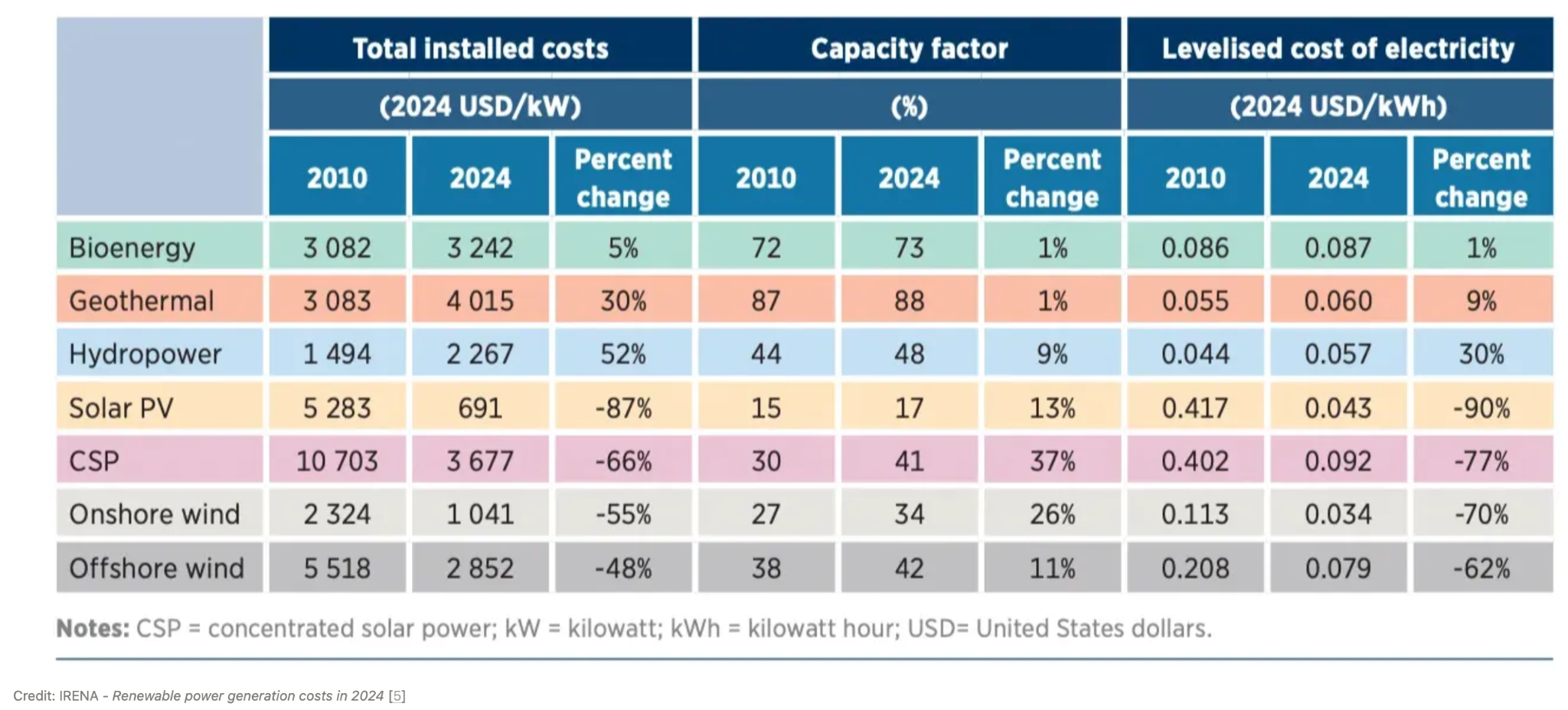

Geothermal Electricity costs are up: reflecting recent innovation

Despite some technical progress, cost reductions have been marginal. Indeed, as low-hanging fruit sites have been exhausted, the Levelized Cost of Electricity (LCOE) for new projects rose: compared to 2010 it was 31% up in 2023 and 9% up in 2024 [4][5]. Consequently, achieving energy outputs comparable to 2010 levels now requires drilling deeper or the installation of larger heat pumps and turbines. This trend also illustrate the sensitivity of projects to site-specific parameters and emergence of Enhanced Geothermal System projects that are currently more expensive than conventional geothermal projects (up to $15,000/kW).

It is also true that geothermal energy has not benefitted from the same level of investment compared to other renewables. As noted by Zenon: “advancements in cost reductions have not kept the same pace with other renewables. This is most likely due to geological uncertainty specific to geothermal energy development, as well as the difficulty to industrialize this technology”. [6]

In other words: We have the technology to harness a heat flow and drill deep but knowing how the holes are going to behave when we drill and as we operate the facility is extremely complicated. Definitely less appealing for an investor than financing another solar PV project with proven profitability !

Regarding electricity generation, more cost-effective energy alternatives are currently available in the market with state-of-the-art drilling technology.

However, this conclusion must be qualified by the fact that EGS & AGS technology have not yet reached the bottom of their cost curve and that significant cost reduction potential will happen unlocked by massive investments notably in the US. Moreover, a simple LCOE comparison is misleading from a grid perspective, as it ignores the critical value provided by geothermal's dispatchable energy compared to intermittent solar or wind energy.

Heat competitiveness despite cost increase

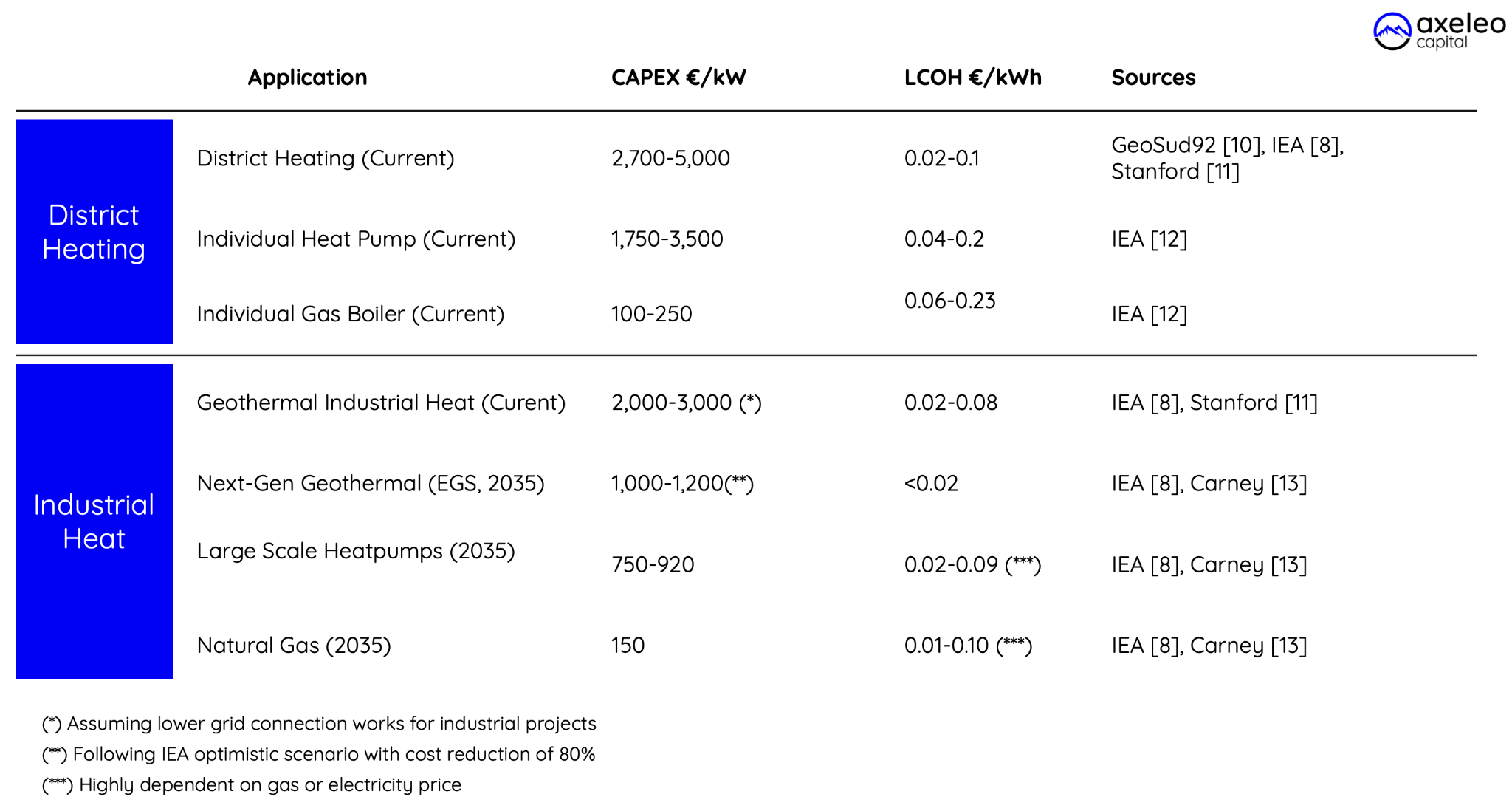

If we narrow down the focus to heat, we notice the same cost uplift. The GeoDH report (2014)[7] identified investment costs between €1,000 and €1,500/kW, while the latest IEA outlook (2024) [8]places the current CAPEX for conventional district heating systems closer to €2,600/kW. The recent Schwerin project (2023) in Germany hits just around this target at €2,700/kW.

Industrial project are often thought to cost less as they don’t always need expensive connection works compared to district heating. Connection works include activities such as trenching, drilling, and piping from the borehole to link the ressource to the existing heating system. It costs around €1m to €1.5m/km according to GeoDH. [7]

However finding the resource next to the plant is not so common, when the distance increase you hit the same 2,000-3,000 range. The Rittershoffen Roquette project (2016) for instance reached 2,300€/kW delivering steam at 165° with a 10km pipe work to connect the ressource to the facility. [9]

Again, this confirms the high opportunistic degree of geothermal technology, co-locating a facility to the ressource makes it already competitive with the incumbents.

The table below provides indicative cost ranges for geothermal heat projects in comparison to other technologies:

Reaching the <€1,100/kw target set by the IEA consistently would make geothermal heat undoubtedly competitive with other technologies. This could realize the scenario projected by EPIT for 2040-2050, where geothermal energy could make up to 30% of heating and cooling demand in Europe. Otherwise geothermal will remain confined to site-specific parameter or high-level of subsidies.

Incumbent technology & challenges for geothermal energy

What does it take to bring geothermal to the next-level, making it cheaper and available in more geography? Stakes are different depending on geothermal projects development steps:

- Exploring & Permitting: covers every activity before the first production hole is drilled (i.e. securing land, exploration and seismic survey, test holes). We have chosen not to address this topic, key drivers of innovation are related to software and AI development.

- Subsurface development: drilling, casing, fracturing installing the underground pipe network to harness the desired quantity of energy.

- Surface Development: building the plant itself. Installing a turbine for electricity generation or heat-pumps for heat collection.

Subsurface Development

The drilling technology stack is dominated by rotary drilling using Polycristalline diamond Compact (PDC) drill bits. Simply put rotary drilling refers to the machine, it uses a drill pipe to apply downward pressure. PDC are solid metal bits that shears the rock away, it is the cutting interface that is in contact with the rock.

These technologies work good, limitations exist however: reliance on drilling fluids or abrasive rocks justify using percussive drilling and roller cones instead (that are also cheaper options). Furthermore, PDC technology has not yet reached its peak. R&D efforts are currently focused on optimizing bit designs to match the specific geology of target rocks (see ZerdaLab).

Once the holes are drilled, the next steps depend on the goal: flowing fluid through the rock or keeping fluid contained.

- Flowing fluid through the rock (e.g EGS, traditional geothermal): include fracturing or horizontal drilling to create permeability. This is currently the most efficient technique to harness heat, but it faces seismicity issue that can completely stop projects before they even get to put energy on the grid

- Keeping fluid inside the pipe (e.g. Advanced Geothermal System, see Eavor German project): it reduces seismicity risks, but hinders heat transfers requiring more drilling to enhance borehole contact. Innovation here includes exploring conductive materials in well cement (see Isol8)

Surface development

This depends on the final application:

- Electricity: technology such as flash steam, dry steam, binary turbine, (See Exergy, Turboden) and ongoing innovation in working fluids (See Factor2Energy)

- Heat: circulation pumps, heat exchanger. For lower temperature range at lower depths, the integration of large-scale heat pumps is required.

Capex Breakdown

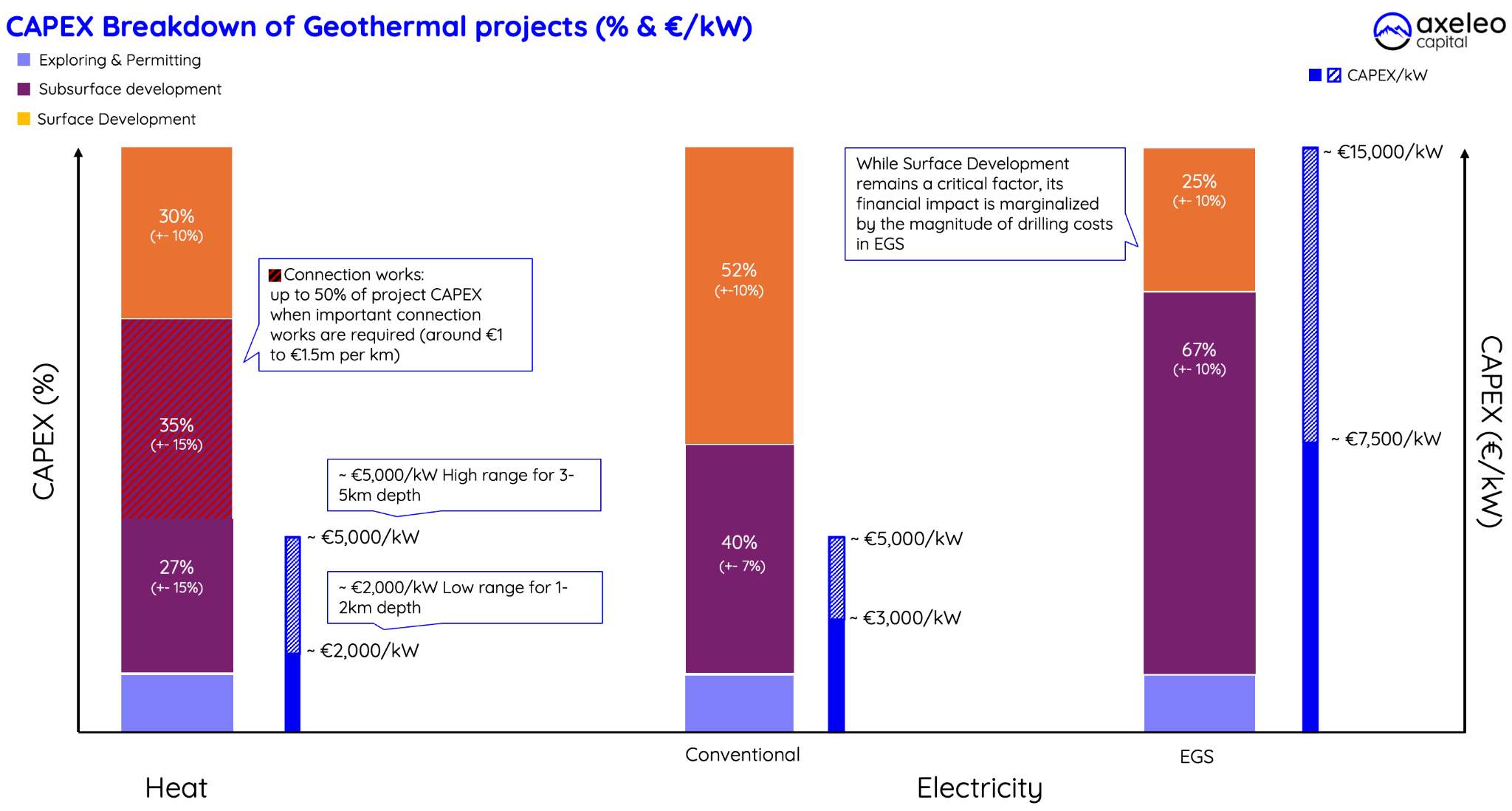

The following graph provides a breakdown of the CAPEX requirements for each development steps and the innovation levers associated to each:

Heating Projects (drilling at 1,200-1,500 meters depths): Connection works are the primary bottleneck, representing up to 50% of total capital expenditure.

Around 63% of CAPEX are related to Subsurface development among which 27% are associated to drilling and 35% (+/- 15%) are associated to connection works. Surface development represents ~30% which can also fluctuate depending on equipment required (heatpumps or not).

EGS Projects: Drilling efficiency is the 'make or break' metric.

Illustrating the weight of drilling work in EGS, subsurface accounts for ~67% of CAPEX, compressing surface development costs to 25% (still important in absolute costs) compared to the 50% standard in conventional geothermal. Even though recent developments are promising: Fervo Energy announced in 2024 that they have managed to cut drilling time by 70% thanks to their technology [10]. The Series E amount raised by Fervo confirms that EGS is still associated with massive upfront costs.

Deploying geothermal heat further: bringing down costs, diversifying revenues

Following this track requires pulling the trigger today: given geothermal development timelines, bringing new technology to the market is critical to improve unit economics and make geothermal project more competitive to other renewable energy solutions.

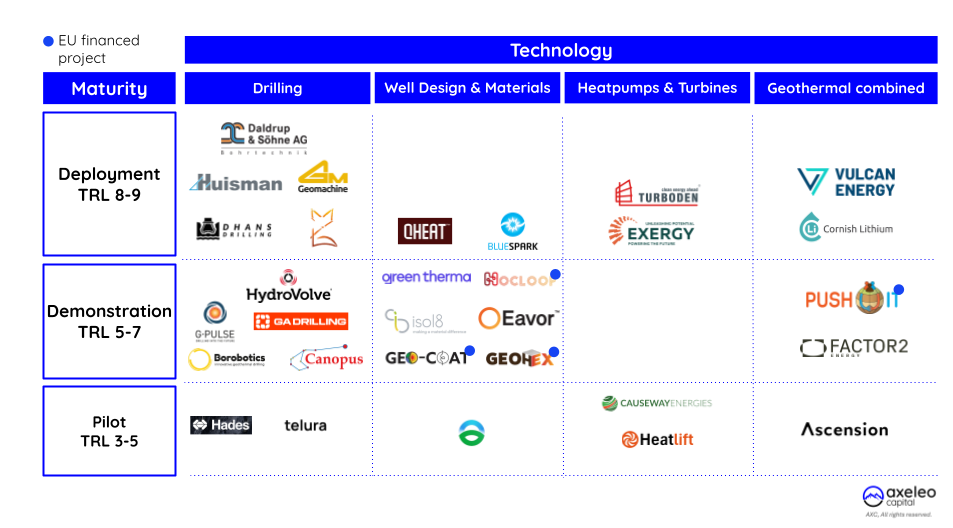

On the Cost Side it is mainly about CAPEX Reduction, drilling and construction currently account for the majority of a project's CAPEX. To address this, we look for technologies that deliver:

- Drilling: Faster with less downtime (startups like GA Drilling, Telura, Canopus)

- Well design: Architectures that increase harvesting per well, or reducing the total number of wells required (for instance coaxial wells see GreenTherma).

- Conversion efficiency: Next-generation turbines and heat pumps (see Turboden, Exergy)

On the revenue Side, we target technologies that diversify income streams and stack more value on the project lifetime:

- Energy storage: enabling seasonal thermal storage to increase profitability of projects (see QHeat)

- Mineral Extraction: Mining critical raw materials as a by-product from geothermal brines (see Hades Mining)

- Increasing operational life of wells: increasing well lifetime with stimulation or retrofitting former oil wells (see Blue Spark)

We have mapped these innovation levers and our view on their market maturity below

Our Take on the required Tech Stack in Europe

Based on the mapping above, here is what we think could advance the space in Europe:

- Drilling Technologies: We expect PDC to remain the industry standard, with room available for optimization. The winning strategy for alternative drilling methods is therefore hybridization: assisting PDC bits to drill faster and last longer (pre-fracturing the rock), rather than attempting to replace them entirely. (See G-Pulse)

- Geothermal Seasonal Storage: The capacity to efficiently store energy across seasons may bring geothermal to the next-level. It unlocks the greater economic potential of wells and aquifers (see QHeat Lounavoima project or PUSH-IT project)

- Industrial heat: co-location models with thermal needs in the range of 90°-150°. Unlike district heating, these projects eliminate the need for extensive distribution networks (pipes), significantly lowering CAPEX and optimizing the project's equation.

Conclusion: The "Heat First" Strategy

So, is there a path for Europe? Yes, going "full gas" on heat which accounts for 40% of the total energy emissions and benefits from a favorable political agenda.

The resource is available at medium depths, the technology is deployable and provides a non-volatile cost of energy. If connection works are reasonable geothermal heat is undoubtedly one of the most interesting technology to decarbonize heat.

Reducing upfront costs with new drilling techniques would be a game changer for both electricity and heat. However widespread cost reductions may not materialize immediately; in fact, the 10-year trend suggests costs could continue to climb in the next few years.

In the meantime, the industry must be looking beyond drilling for solutions. Exploring new revenues streams is one of them, it has the benefit to de-risk projects in their early phase (mineral extraction) while boosting the ROI (storage or well retrofit).

If you are building in the geothermal space feel free to reach out!