Cybersecurity Index | Q4 2025

Cybersecurity Index Q4 2025 - Key Insights

Axeleo Capital (AXC) publishes the fourteenth edition of its “Cybersecurity Index”, a quarterly review of the European Cybersecurity ecosystem that monitors the pace of investments and innovation in the sector.

Quantitative Insights

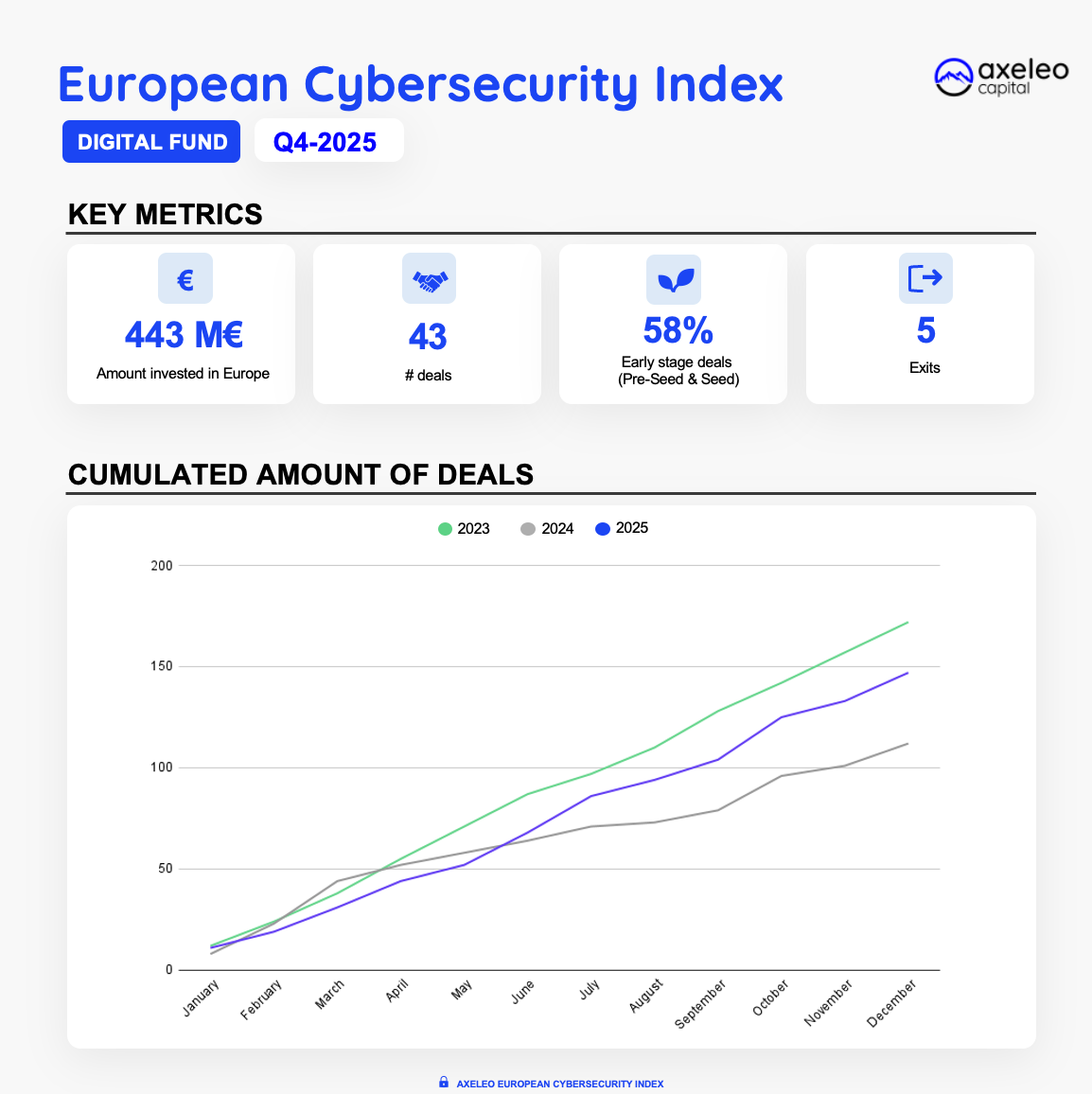

The European cybersecurity sector finished 2025 on a record-breaking note, securing €443 million across 43 deals in Q4-2025. This represents a massive acceleration compared to Q3 (€216M), more than doubling the total amount invested. Unlike the previous quarter, this growth was driven by a surge in late-stage activity, although the innovation pipeline remains healthy with 58% of transactions in Early-stage (Pre-seed & Seed).

Zooming out, Q4 2025 has been by far the most active quarter in the last twelve months, showing a growth boost in the sector and making it significantly more dynamic than the €176 million raised in Q4 2024.

Key Highlights for Q4 2025

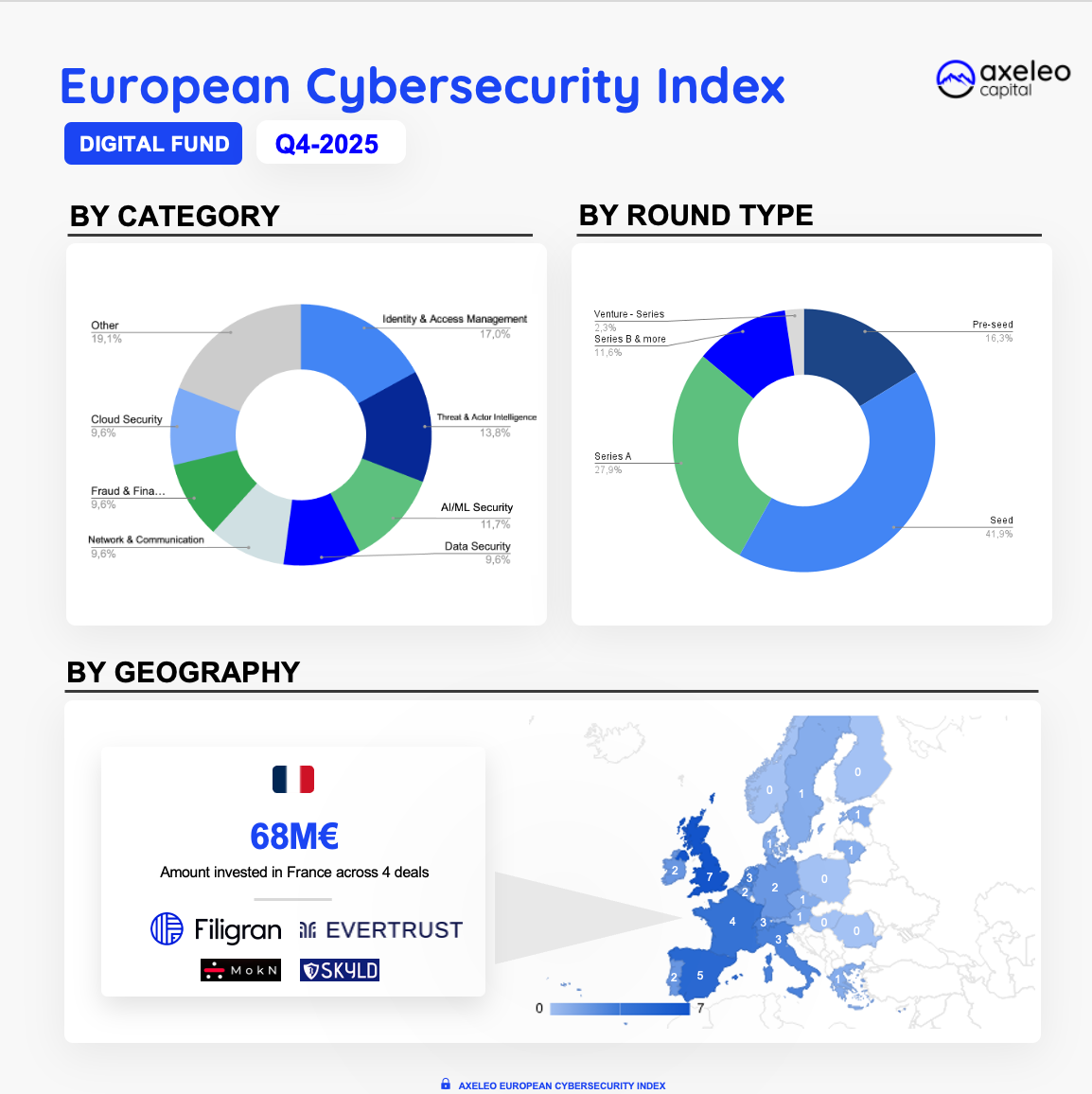

- Geographical breakdown: the UK still leading in volume and Italy in total funding

The United Kingdom maintained its position as the high-volume leader with 7 deals (€25M) , while Spain climbed to second place in deal count with 5 transactions totaling €33M, a notable increase from its 3 smaller deals in Q3.

However, the quarter was defined by massive individual rounds that shifted the funding leadership. For the second consecutive quarter, Italy surged to the top of total funding, raising €113M across just 3 deals—once again propelled by Exein that raised a €100M venture round following its €70M Series C in Q3. Portugal followed closely as a value leader, ranking second in total funding thanks to Feedzai’s €70M Series E.

Meanwhile, France staged a strong recovery after a quiet Q3, recording 4 deals for a total of €68M, including Filigran’s €54M Series C and Evertrust’s €10M Series A.

- Balanced Funding by Sector Activity, with Identity Management and Threat Intelligence Leading

Top funded categories in Q4 2025 were:

- Identity and Access Management (17% of deals)

- Threat & Actor Intelligence (13.8%)

- AI/ML Security & Compliance (11.7%)

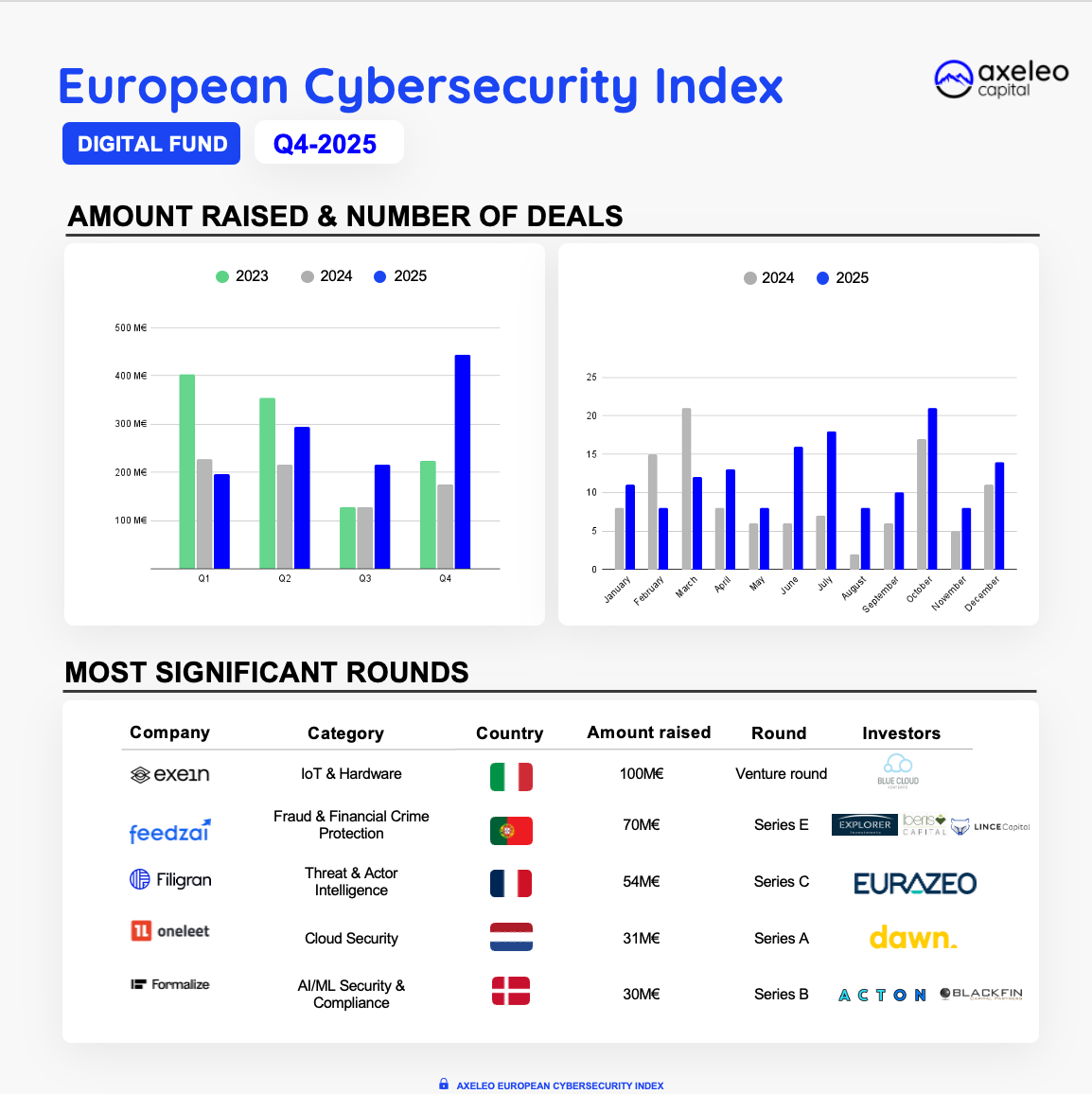

- Growth in Later-Stage Deals

While early-stage rounds remained the primary volume driver with 18 Seed and 7 Pre-seed transactions , they accounted for 41.9% of total deals—a significant decrease from the 64% seen in Q3-2025.

This shift highlights a move toward larger operations, pointing to increasing maturity in the sector. Indeed, Series A rounds surged to 27.9% of total activity, while Series B and later stages reached 11.6%. This increased concentration of mid-to-late-stage deals explains the substantial spike in total funding observed this quarter.

- Top Deals of the Quarter

- Exein (IT) – €100M Venture Round

AI-powered embedded IoT security platform providing runtime protection directly within device firmware.

- Feedzai (PT) – €70M Series E

AI-native risk management platform providing end-to-end fraud prevention and financial crime protection for banking and commerce.

- Filigran (FR) – €54M Series C

Open-source cyber threat intelligence and crisis management platform enabling organizations to centralize, analyze, and operationalize threat data.

- Oneleet (NL) – €31M Series A

Comprehensive "Pentesting-as-a-Service" platform that automates security workflows and streamlines compliance for modern engineering teams. - Formalize (DK) – €30M Series B

Automated GRC and whistleblowing platform designed to simplify data privacy and regulatory compliance operations.

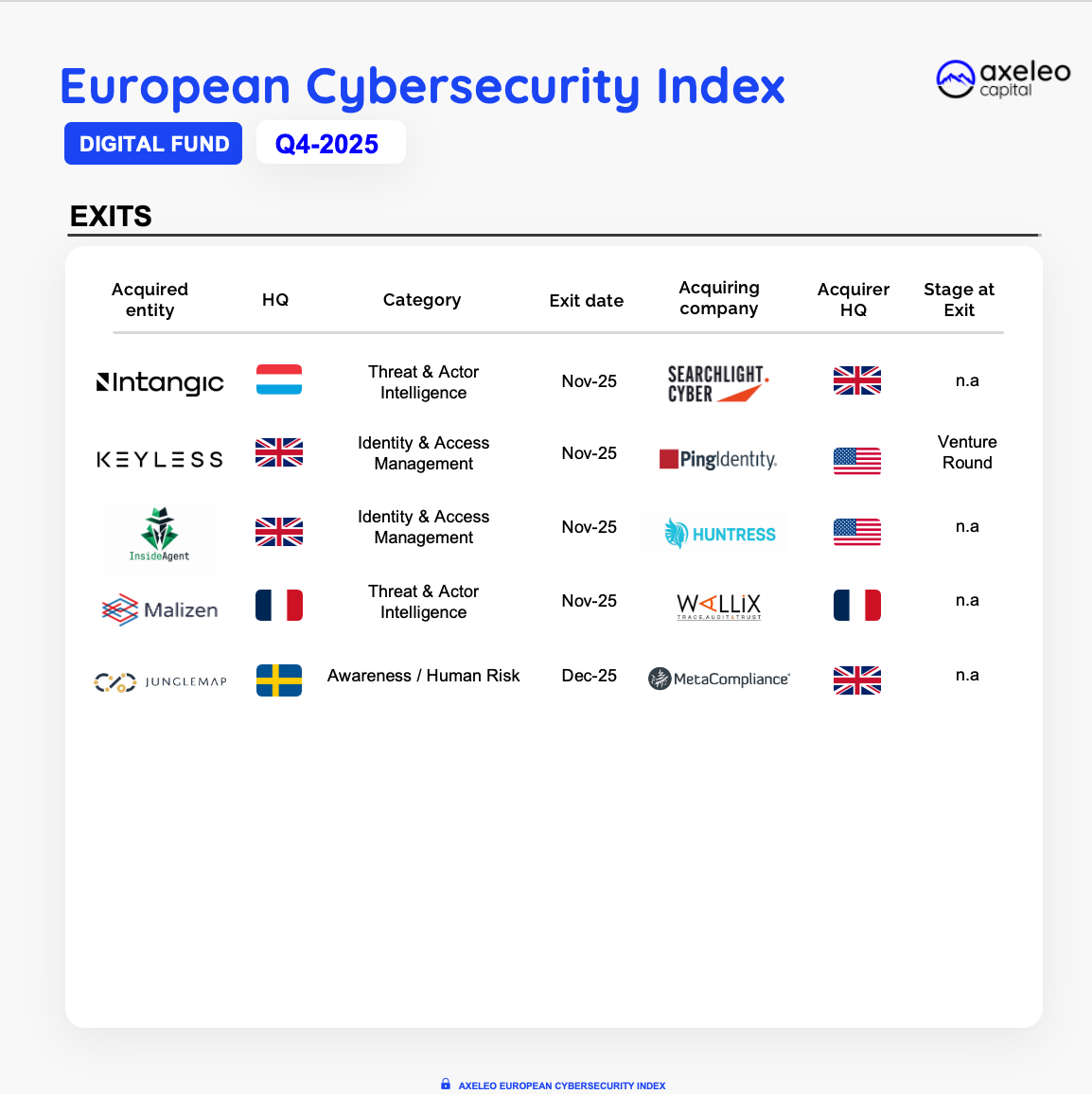

Exit Activity

Q4 recorded 5 exits, signaling a noticeable deceleration in M&A momentum compared to the robust activity seen earlier in the year.

Despite this cooling trend, November emerged as a focal point for consolidation, accounting for 4 of the 5 transactions. These moves were highly concentrated within the Threat Intelligence and Identity Management sectors, mirroring the investor preferences observed in recent funding rounds. Geographically, the market was dominated by US and UK-based acquirers, underscoring their continued role as primary consolidators of European innovation

Strategic moves include :

- Intangic (NL), a Threat Intelligence company acquired by Searchlight (UK)

- Keyless (UK), acquired post venture round by PingIdentity (US)

- Diversity Remains a Challenge

In Q4-2025, only 4 deals involved at least one female founder (Cybaverse, Sitehop, Skyld and ITUS Secure Technologies), pushing the quarterly ratio to ~9%. This ratio, though steadily progressing throughout 2025 from the ~3% in Q1, still reflects an ecosystem lacking structural diversity in founding teams, especially at later stages.

Methodology:

The Cybersecurity Index is based on data from Axeleo Capital's analysis as well as databases, such as Crunchbase in particular. These data sources mainly gather information on deals and rounds that have been publicly disclosed - many other raises are taking place, but without announcements or communications on amounts (thus difficult to track). The analysis is limited to companies headquartered in Europe, and with a value proposition focused on Cybersecurity. As far as recorded fundraising is concerned, this refers to equity venture capital fundraising only (i.e. excluding debt fundraising, subsidies and aid other than equity).

About Axeleo Capital:

Axeleo Capital 2 is a €70 million venture capital fund dedicated to B2B Tech start-ups, including cybersecurity, across Europe. Axeleo Capital is a venture capital firm active on the European technology scene and backed by a large pool of entrepreneur-investors. The fund offers startup founders a unique support framework that combines equity investment, operational and strategic coaching and an active ecosystem of over 100 high-level partners and mentors. Its Cybersecurity investments include Seedata, Trustpair, Citalid, Mantra, Yogosha (exit) and Alsid (exit).